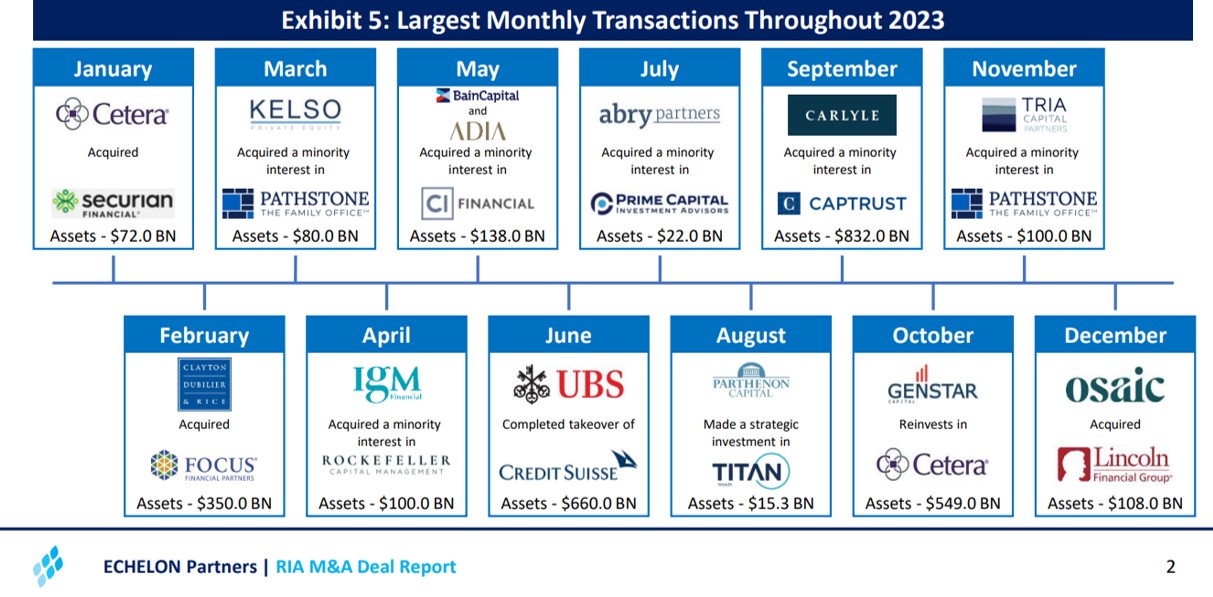

With deals involving Captrust, Focus Financial, The Carlyle Group, Pathstone and others, 2023 saw plenty of M&A activity in the registered investment advisor space, although it wasn’t able to beat the volume of deals a year earlier amidst economic uncertainties.

Figures from ECHELON Partners, a firm advising wealth managers on corporate deals, showed that last year a total of 321 transactions were announced, down 5.9 per cent from 2022’s record of 340. Last year saw the chilling impact of rate rises and the demise of Silicon Valley Bank, among others.

In other details, ECHELON said that average assets per deal rose 3.9 per cent, buoyed by a run of transactions where AuM ranged from $10 billion to $20 billion.

“Another driver of deal size was the heightened creativity in deal structures, adopted by private equity firms seeking to get deals across the finish line in the face of higher borrowing costs,” ECHELON said in its report. It noted that “structured minority investments, with features such as paid-in-kind and preferred distribution rights, have become more popular with buyers.”

Such approaches have gotten more popular because leveraged buyouts became harder to complete.

With private equity houses such as The Carlyle Group, Genstar Capital; Bain Capital, TRIA Capital Partners and other firms in the mix, ECHELON said that financial sponsors were directly or indirectly involved in 61.1 per cent of all disclosed transactions in 2023. In total, private equity firms made 27 direct investments in 2023, the same as in 2022. The size of the deals also grew “significantly,” suggesting that private equity hunger for the wealth space wasn’t affected by a shift to higher interest rates.

ECHELON said a “more restrictive financing environment has led to a decrease in general M&A activity” but added that “the wealth management industry has remained resilient due to factors such as fierce buyer competition, business model resiliency and demographic tailwinds.”

Elsewhere, data showed that RIAs, particularly those private equity-backed firms running programmatic acquisition programs, remained the most active buyers in the industry. Last year, RIAs were involved in 228 deals, amassing a total of $466 billion in assets. Insurance firms were also important in the sector, buying $178 billion in assets. Notable examples included Aon’s acquisition of NFP’s $75 billion of assets, and Canada Life Assurance Company’s acquisition of Investment Planning Counsel’s $85 billion in assets, ECHELON said.